How Soon Can You Apply for Credit After Closing

Waiting nigh vi months betwixt credit carte applications can increase your chances of getting canonical. Utilise more than frequently than that, and issuers may meet you every bit a riskier bet and refuse your application.

The exception? If you have excellent credit, a loftier income and a history of on-time payments, you can probably utilise for new credit cards more ofttimes and still go approved. That'due south because y'all're the kind of client card issuers meet as having a low hazard of defaulting on future payments.

On the other hand, if your credit is boilerplate or worse, yous might demand to look even longer between credit card applications — maybe as a long as a yr — to increment your chances of blessing .

Multiple applications suggest run a risk

Credit carte du jour issuers view multiple carte applications in quick succession as a sign of fiscal distress. It raises red flags about your ability to make future payments and keep your accounts in good standing. In fact, FICO says that people with six or more than inquiries on their credit reports are eight times more than likely to declare bankruptcy compared with those who have no inquiries on their reports.

However, FICO also says there are more of import factors in your risk profile than the number of credit applications: whether yous pay your bills on time and your overall debt burden. That's why people with great credit tin can get away with more frequent applications and withal get approved. If you accept excellent credit, waiting three months between card applications is a good guideline, simply it's not a hard-and-fast rule.

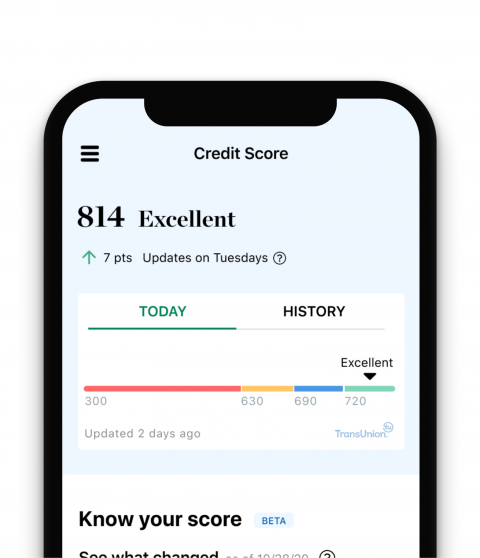

Find the best card for your credit

Check your score anytime, and NerdWallet will show you which credit cards make the most sense.

When to exist extra cautious

A few special circumstances require extra caution when information technology comes to timing your credit card applications:

When y'all're buying a home. If yous'll exist applying for a mortgage in the near future, accept actress care to infinite out your credit menu applications at least six months apart. Each credit card application typically knocks a few points off your score. You don't desire to risk lowering your score, even a footling, when it could increase the cost of your mortgage. Even a slight increase in your dwelling loan rate tin price y'all thousands of dollars over time, so you want your credit score to be equally high as possible when you apply. Wait until later you lot've signed the mortgage to apply for a credit carte du jour. Whatever the sign-up bonus is, a higher charge per unit on a dwelling house loan will cost yous more.

When you're trying to rebuild your credit. If your credit has been damaged in the past, you'll desire to re-establish it slowly and advisedly. You'll also desire to avert temptations that may take gotten you lot into problem earlier. Even if yous call back y'all could get approved, look at least half dozen months betwixt applications to make sure you won't get into trouble again.

When you have bad or express credit. Having v points knocked off your score because of a credit card awarding isn't a huge deal if your score is 800. Information technology's a much bigger problem if your score is 500 or 600. If y'all take poor credit or no credit, y'all should apply for new cards less frequently than someone with fantabulous credit. Likewise, be sure you are applying for cards appropriate for your credit score . Rewards credit cards and those with generous 0% interest offers are by and large aimed at customers with good to excellent credit. Others, such as secured cards, are designed with credit builders in mind.

When you have been rejected recently on a carte application. Your instinct might be to immediately apply for several other cards, but doing so could farther hurt your chances of approval. Instead, consider calling the menu issuer to ask why your awarding was rejected . You lot may acquire something that you can accost, such as fixing an error on your credit study or establishing a longer menses of on-time bill payments.

You can and then work toward improving your credit by paying bills on fourth dimension and reducing your outstanding debt. Then, after waiting at to the lowest degree six months, effort applying again with a stronger take chances of approval.

Source: https://www.nerdwallet.com/article/credit-cards/long-wait-credit-card-applications

0 Response to "How Soon Can You Apply for Credit After Closing"

Post a Comment